Should i borrow maximum mortgage

If you have student debt and are planning to buy a house the amount you can borrow on a mortgage will be lower because you have to be able to continue your monthly student debt payments as well. Assuming a 30-year mortgage that amount of 630000 can then be used to gradually pay for his mortgage over the next 360 months.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

CLTV FOR RATE SHOWN 60 of your homes value.

. How much can I afford to borrow. Multiply your annual salary by 036 percent then divide the total by 12. Should I consolidate my loans.

The longer term will provide a more affordable monthly. With a capital and interest option you pay off the loan as well as the interest on it. Use our mortgage calculator to calculate your maximum mortgage with ABN AMRO in 2022 and get instant information on how much you can borrow.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. So we will be able to let you know how much you can borrow depending on your employment status income and affordability calculations and also what it will cost including all associated costs and fees. At the end of the mortgage term the original loan will still need to be paid back.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Graduate students can borrow up to 20500 annually and 138500 total. How long will I live in this home.

Find out what you can borrow. There is no maximum debt ratio. This is the maximum amount you can pay toward debts each month.

Your insurance provider covers 125 of your mortgage. The 28 percent rule which specifies that no more than 28 percent of your gross income should be spent on your monthly mortgage payment is a threshold many lenders adhere to explains Corey. As a requirement you must make a 5.

You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. That would give him 1750 a month to put toward a housing payment. This calculator helps you work out the most you could borrow from the bank to buy your new home.

Plan for Your Mortgage Loan. Subtract your other debts including your car payment your student loan payment and other debt payments from this amount to determine the maximum amount you can spend on your monthly mortgage payment. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

Remember youll have to pay that borrowed money back plus interest within 5 years of taking your loan in most cases. We are an expert mortgage broker with access to over 12000 mortgage products from more than 90 UK lenders. Financing up to 97 loan-to-value.

Customers and applicants can borrow anywhere from 100 to 35000 with repayments able to be made over the course of 3 to 24 months. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Choose from our easy to use calculators to plan for your home.

Or 4 times your joint income if youre applying for a mortgage. The maximum number of points varies by lender but it is uncommon for consumers to pay more than 4 discount points. This is called your borrowing power.

Undergraduates can borrow a maximum of 9500 to 12500 annually and 57500 total. With a 401k loan you borrow money from your retirement savings account. Purchase or refinance.

With an interest only mortgage you are not actually paying off any of the loan. There is no maximum loan amount. Mortgage Rates.

The maximum loan amount is 50 of your 401ks vested account balance or 50000 whichever is less The loan must be paid back with interest typically the prime rate plus 1-2 on a schedule. Purchase or no-cash out refinance options. So if your home is worth 250000 and you owe 150000 on your mortgage you have 100000 in home equity.

Subtract the amount remaining on your mortgage 200000 and youll get the approximate sum you can borrow as a home equity. The mortgage should be fully paid off by the end of the full mortgage term. VAs residual income guidelines ensure Veteran borrowers can afford the loan and determine how much money a Veteran must have left over after all debts and.

No maximum income limits. The precise loan amount you can borrow from our panel of lenders does depend on various factors such as on your personal income your financial position credit ratings and what debts and commitments you currently have. However the lender must provide compensating factors if the total debt ratio is more than 41 percent.

What is my loan rate. How Many Discount Points Can I Buy. Some lenders showcased in the above mortgage rate table list whole-number points while others may offer loans with no points or fractions of a point like 079 points.

MAXIMUM TERM FOR RATE SHOWN 5 Years. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage. Depending on what your employers plan allows you could take out as much as 50 of your savings up to a maximum of 50000 within a 12-month period.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. How much can I borrow. That gives you a maximum of 297500 in value that could be borrowed.

How much will my loan payments be. That doesnt mean youll be able to borrow up to 100000. Borrow up to 647200.

Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy.

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

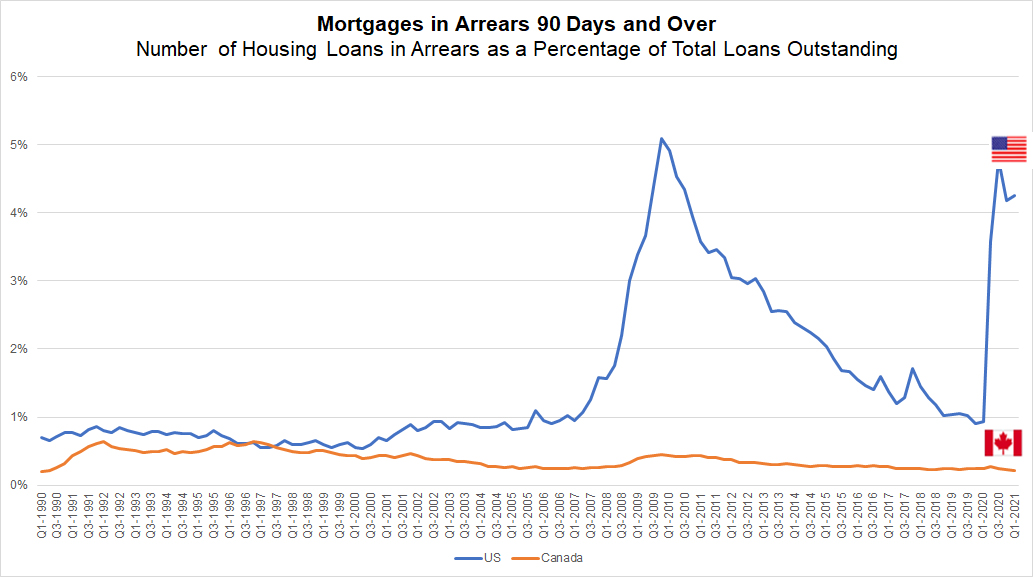

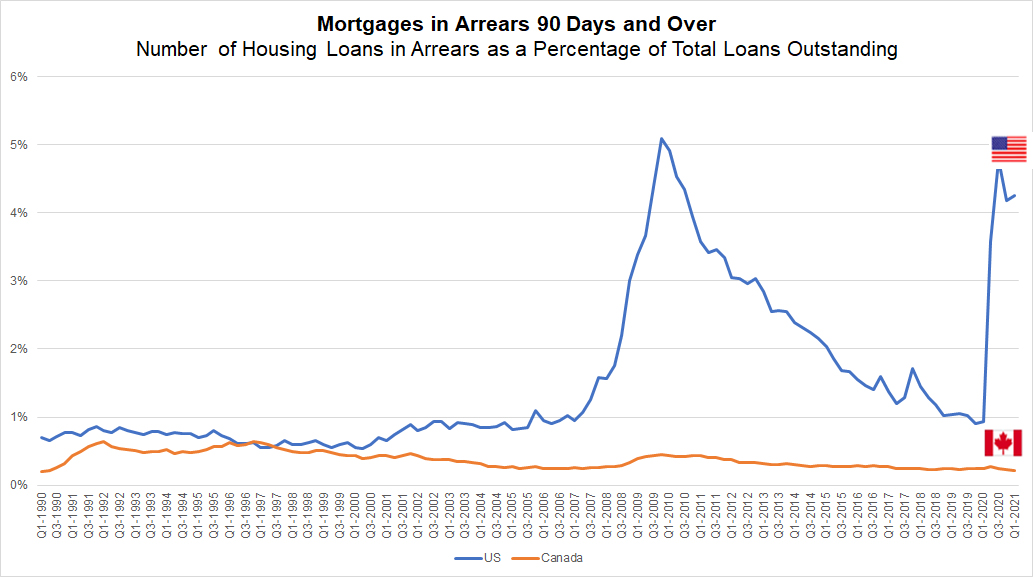

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Investing Calculator Borrow Money

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

How To Increase The Amount You Can Borrow My Simple Mortgage

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

How To Increase The Amount You Can Borrow My Simple Mortgage

Pin On Ontario Mortgage Financing

What You Need To Know About 401 K Loans Before You Take One

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Much Can I Borrow For A Mortgage Fortunly Com

What Is A Collateral Mortgage Benefits Vs Risks Wowa Ca

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake What Is Escrow Down Payment Investing Money